how are rsus taxed at ipo

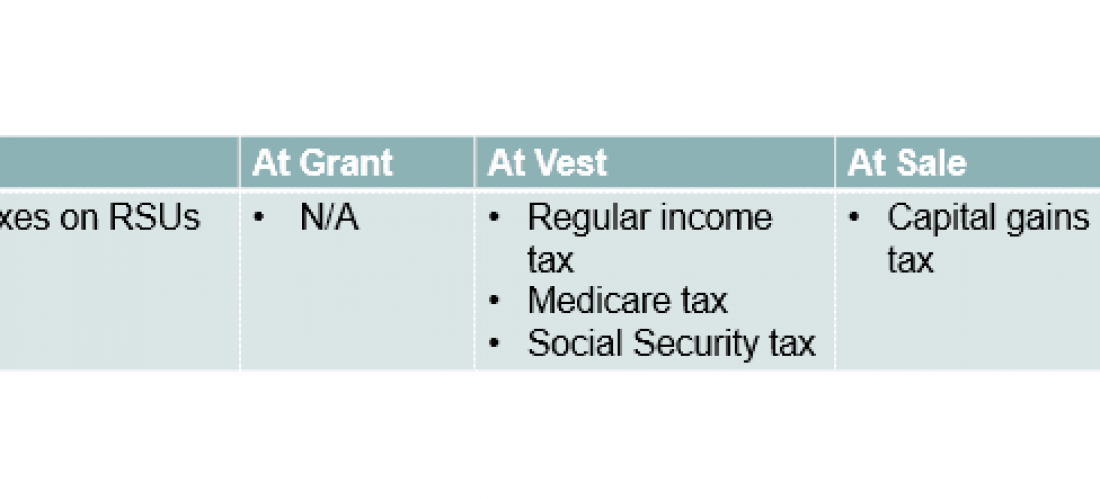

If a company is already public RSUs are usually taxable when. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

Rsu Taxes Explained 4 Tax Strategies For 2022

Dec 10 2020 3.

. You are granted some RSUs. My grant price per RSU was 20. Your company has its IPO.

I vested 2 years worth of RSUs. Capital gains tax only applies if the recipient of RSUs does not sell the stock. Since RSUs are taxed upon transfer of shares to the participant this is commonly at vest.

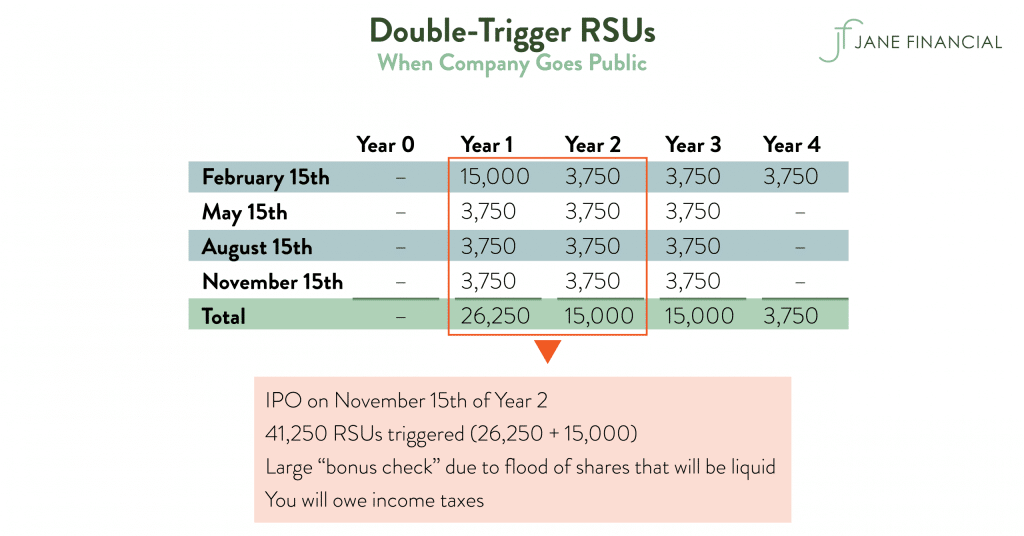

Your RSUs vest and become taxable 180 days after Event 2. FICA taxes and all. With RSUs there are no decisions to be made except for when you sell them.

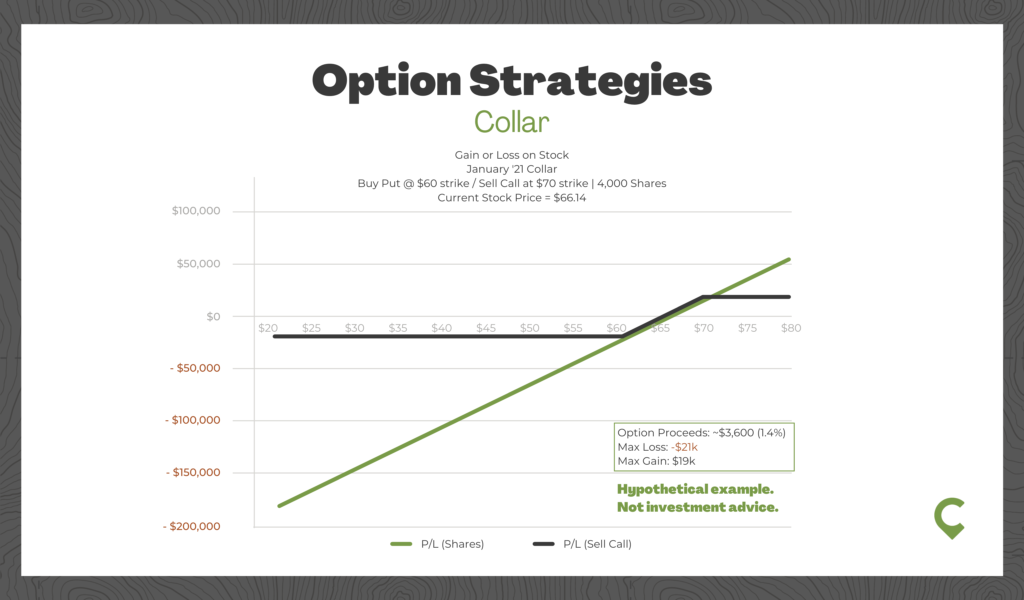

RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO. Hi Blind making some numbers up to stay anonymousI was given 100k worth RSUs vestable quarterly over 4 years. RSUs at IPO - Potential Risks and Pitfalls to Look Out For IPO Pitfall 1 - Taxes Withholding Preferences.

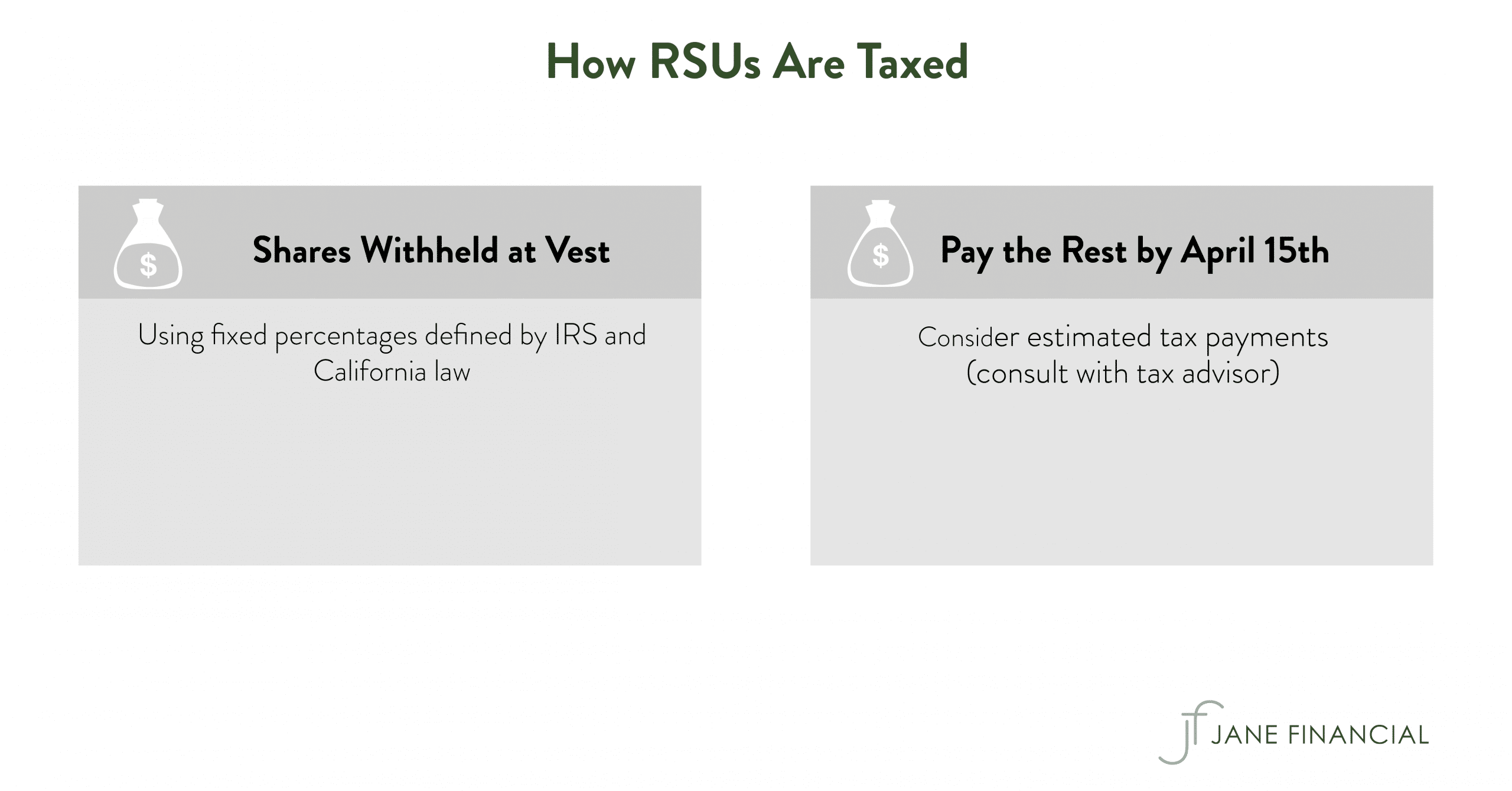

If your company grants you RSUs the total amount vested at the time of IPO is classified as supplemental income and is taxed at the regular income tax bracket rate. Which means that once your company is public youll need to stay on top of your tax bill throughout the year because youll need to pay additional taxes on RSU income. As tax season begins some of Ubers earliest employees are realizing they had little idea how their stock grants worked and are now.

Compare how the total payout may change between options and RSUs. Posted by 23 days ago. The amount of income to report.

Post IPO vesting causes your tax bracket to. When RSUs are issued to an employee or executive they are subject to ordinary income tax. Input all the shares vested and the IPO price in the boxes below.

Posted this first on rIndiaInvestments but didnt get any response. Like bonuses and commissions vested RSUs are considered supplemental wages. How are RSUs of a pre-IPO company taxed.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. For estimating taxes for IPOs. Supplemental wages are taxed based on a series of flat rates as defined the IRS and your state tax authority.

RSUs can trigger capital gains tax but only if the. How are RSUs of a pre-IPO company taxed. All your vested RSUs will be granted on the day of IPO so you will have only 1 vesting event.

Palantir DPOed and had no lockup on RSUs so everyone could sell to cover taxes immediately on listing day. Ad Thinking of switching from stock options to RSUs restricted stock options. However in the case where the company requires or a participant elects a deferred.

Once they vest they get taxed and they are in your possession.

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Tax Planning For Stock Options

Rsu Taxes Explained 4 Tax Strategies For 2022

Equity Compensation 101 Rsus Restricted Stock Units

Tax And Stock Option Free Quizzes How To Become Smarter Continuing Education Credits Free Quizzes